The offer for New Britain Palm Oil Ltd would give Sime Darby over 140,000 ha of oil palm and sugar plantations in Papua New Guinea, as wells as 28,000 ha of lands on which to expand.

Sime unit makes RM5.6bil conditional general offer for NBPOL

BY HANIM ADNAN

KUALA LUMPUR: The Sime Darby Group, via plantation arm Sime Darby Plantation Sdn Bhd, has launched a conditional general offer (GO) to acquire all the shares in dual-listed plantation group New Britain Palm Oil Ltd (NBPOL) at £7.15 (RM37.54) per share for a total purchase consideration of £1.07bil (RM5.6bil).

The GO will be subject to Sime Darby receiving a minimum acceptance of 51% of the NBPOL shares, an assurance that the offer will not be contrary to Papua New Guinea’s (PNG) national interest, and meeting the regulatory requirements by the London Stock Exchange (LSE), the Port Moresby Stock Exchange, the PNG government and Bursa Malaysia.

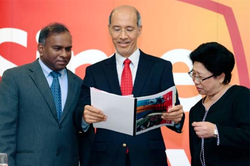

Sime Darby president and group chief executive Tan Sri Mohd Bakke Salleh told a media briefing that Sime Darby had obtained a written confirmation from PNG Prime Minister Peter O’Neill last week acknowledging its proposed acquisition of NBPOL, and that it would not be contrary to PNG’s national interest in relation to Rule 27A of the PNG Takeovers Code.

NBPOL’s independent directors have also indicated that they intend to recommend that NBPOL shareholders accept the GO by Sime Darby.

NBPOL is a fully integrated producer of certified sustainable palm oil with 135,000ha of brownfield assets, 12 mills and one refinery each in PNG and Liverpool, the United Kingdom, as well as the largest sugar cane and beef producer in PNG with a market capitalisation of US$1.3bil as at Aug 4 this year.

The GO on NBPOL by Sime Darby yesterday took many by surprise, after the plantation conglomerate had recently announced its intention to walk away from its proposed acquisition of Kulim Bhd’s 49% stake in NBPOL with no specific reasons given.

Bakke explained that “right from the start, Sime Darby was not only focusing on Kulim’s block in NBPOL because ideally, we would like to end up with at least a 51% stake in the company”.

The takeover allows Sime Darby to assume both NBPOL’s management and board control.

“In the course of our negotiations with the stakeholders, we realised the key factor here is to get the support from the PNG Government. Right till the last day of our exclusivity agreement with Kulim, which fell on Sept 28, we still had not received any written letter of confirmation from the PNG Government.”

However, on Oct 1, Sime Darby finally obtained the support letter from PNG’s Prime Minister, which paved the way for it to reactivate its proposed GO on NBPOL.

As at June 30, the major shareholders of NBPOL were Kulim with 49%, institutional and retail investors with 24%, the PNG government and other interests with 22%, and the management of NBPOL with 5%.

Meanwhile, Kulim said in a statement to Bursa Malaysia that it intended to accept the offer by Sime Darby subject to the conditions that there were no better offer for its 49% stake in NBPOL and approval of Kulim’s shareholders in the EGM for the divestment.

Once the deal goes through, Kulim will gain RM2.75bil from the disposal.

In a separate statement, NBPOL chairman Antonio Monteiro de Castro said: “The offer will provide an opportunity for all shareholders to realise their investment in NBPOL at an attractive valuation and we also believe it represents a positive outcome for our employees, customers and other stakeholders.

“By joining the Sime Darby Group (following the successful completion of the offer), NBPOL will benefit from having a strong, supportive partner to drive future expansion and growth in PNG and internationally.” NBPOL expects the offer to be completed by end-December.

According to Bakke, the NBPOL acquisition will be financed via 20% internally generated cash and 80% external borrowings.

“Our current gearing ratio is at 38% but with this acquisition, we expect our gearing to move up to 50% by the current financial year, which ends next year.

“However, we hope to be able to raise cash from Sime Darby Group’s future initial public offering exercises and capex rationalisation. Through these measures, our gearing will then come down again by about 40%,” said Bakke.

Sime Darby is offering £7.15 per share for every NBPOL share, representing a 55.7% premium over the two-month, volume-weighted average price.

The offer values NBPOL at about RM84,000 on an enterprise value (EV) per hectare, which is comparable to recent industry acquisitions.

The EV per ha of RM84,000 excludes two refineries as well as a sugar cane plantation (7,718ha) and pasture land (9,282ha) with 20,000 cattle heads. NBPOL potentially has another 28,000ha of land for oil palm cultivation.

Bakke noted that “the price we have offered for NBPOL is fair and reflective of the underlying value of the business”.

Another factor is that Sime Darby also intends to delist NBPOL from the LSE.

“The stock is illiquid and its current market price is not reflective of the value of the company. In the last 12 months, the average cumulative trading volume on the LSE and the Port Moresby Stock Exchange represents less than 1% (0.45%) of the float.

“We believe it will be good to move NBPOL’s listing from the LSE to this part of the world, either to Bursa Malaysia or the Singapore Stock Exchange. But the preference will be the secondary market in Bursa,” added Bakke.

He pointed out that the group expects the NBPOL transaction to generate value creation to Sime Darby shareholders, with an earnings per share accreation of about 4% to 5% in the next two years.

Bakke stressed that the NBPOL proposed acquisition has presented Sime Darby with a rare opportunity to acquire a low-risk, well-managed ongoing business concern that will add value to its group.

Sime Darby Plantation managing director Datuk Franki Anthony Dass said that “as a brownfield asset, NBPOL will immediately contribute to group earnings without the incumbent risks associated with a greenfield expansion”.