Chain Reaction Research | 30 March 2021

Key Cerrado deforesters in 2020 linked to the clearing of more than 110,000 hectares

The Cerrado biome, a vast, biodiverse tropical savannah in Brazil, is under threat from commodity-driven deforestation. Soy expansion and cattle ranching are direct drivers of forest loss in the Cerrado. This report presents new data on specific actors linked to Cerrado deforestation in 2020, including the quantified risk exposure of the largest soy traders, meatpackers, and retailers. Financiers with forest policies are exposed to material risks in their portfolios.

Download the PDF here: Key Cerrado Deforesters Linked to the Clearing of More than 110,000 Hectares

Key Findings

-

Agricultural expansion is the primary driver of increasing deforestation in the Cerrado. Rising deforestation linked to soy, cattle, and land speculation threatens to disrupt natural water systems, regional climate patterns, and long-term agricultural productivity in the region.

-

Cerrado deforestation in 2020 totaled 734,010 ha, an increase of 13.2 percent versus 2019. Deforestation on private lands accounted for 66.7 percent, while public lands made up 19.2 percent. The remaining deforestation occurred on lands that hold no legal designation.

-

A total of 207,813 ha of Cerrado deforestation in 2020 took place on farms that have had already soy-planted areas. CRR estimates 28.3 percent of total Cerrado deforestation was linked to soy expansion.

-

Over half of soy-driven Cerrado deforestation is linked to prominent soy producers. Farmland owned by local producers, real estate firms, and agribusinesses, such as SLC Agrícola, Nuveen, and JJF Holdings e Participações saw 110,333 ha of deforestation in the Cerrado. Most of these companies have trading relationships with Cargill, Bunge, ADM, Louis Dreyfus Company (LDC), and Cofco.

-

The beef industry is another key driver of deforestation and land speculation in the Cerrado. Meatpackers JBS, Marfrig, and Minerva are highly exposed to Cerrado deforestation in their supply chains, especially in the Matopiba region. Retailers Casino Group, Carrefour, and Cencosud are key beef sales channels, equally linked to deforestation in the biome.

-

The escalation of market access risk, regulation risk, financing risk, and reputation risk could lead to material financial losses for financiers. BNP Paribas, Santander, Rabobank, HSBC, AP2, Caisse de Dépôt, Credit Agricole, Barclays, and Credit Suisse have billions of US Dollars of exposure to top Cerrado deforesters, which is in conflict with their own forest policies. EU regulation on due diligence of supply chain could trigger major divestments and/or engagement.

Agricultural expansion is driving deforestation and native vegetation clearing in the Cerrado

Natural vegetation in the Brazilian Cerrado, the world’s most biodiverse savanna, is under threat from high rates of deforestation.being converted at a rapid pace. Stretching over 200 million hectares (ha), the size of Germany, France, England, Italy, and Spain combined, the Cerrado is a wooded grassland that provides critical ecosystem services to the world. It protects biodiversity, stabilizes regional climate, and regulates watersheds that provide 40 percent of Brazil’s fresh water. It contains 5 percent of all biodiversity in the planet, with 1,600 animal species and 12,000 plant species—of which nearly half are found only in the Cerrado. Its deep root systems act as a critical carbon sink, estimated to store 13.7 billion tons of carbon underground. The Cerrado is also the most productive agricultural region in Brazil, which has resulted in deforestation and land clearing that are destabilizing the ecosystem.

Agricultural expansion is the primary driver of increasing deforestation in the Cerrado. Since agricultural activities expanded in the 1970s, 50 percent of the Cerrado has been lost to agricultural and pasture land primarily for cattle, soy, cotton, corn, and eucalyptus. Despite its critical role in the Earth’s natural systems, the Cerrado has little protection from Brazil’s Forest Code. While the Forest Code requires private landowners in the Amazon to preserve up to 80 percent of their property, landowners are required to set aside only 20-35 percent of native vegetation across the Cerrado. Accounting for publicly protected areas, it is estimated that less than 3 percent of the Cerrado is under legal protection, compared with 46 percent of the Amazon. Environmental protection is further weakened by the lack of environmental enforcement as a result of the pro-business agenda of the Bolsonaro administration. Since President Jair Bolsonaro was elected in 2018, Brazil’s environmental agency Ibama has seen significant budget cuts and the dismissal of key staff. Despite rising deforestation, Ibama issued the least number of fines in since 2019. Environmental fines are one of Ibama’s methods of enforcing conservation laws. Decreased issuance shows how the agency’s capacity has been affected by budget cuts.

Voluntary mechanisms and cross-sector coalitions are calling for the protection of the Cerrado. These include:

-

The Cerrado Manifesto was launched in 2017 by civil society organizations to demand soy producers, traders and retailers to eliminate soy-driven conversion in the region.

-

The Statement of Support (SoS) for the Cerrado Manifesto is signed by 160 consumer goods companies and investors, endorsing the Manifesto’s goals and pledging to halt forest loss linked to agricultural production.

-

Six major commodity traders are members of the Soft Commodities Forum, which puts forward a common reporting methodology for increased supply chain traceability in the Cerrado biome.

-

The Consumer Goods Forum is an industry network composed of over 400 companies that supported the Cerrado Manifesto and established a Forest Positive Coalition of Action to accelerate conversion-free commodity supply chains.

-

More broadly, the Amsterdam Declaration and New York Declaration on Forests are multilateral commitments to eliminate deforestation from the production of agricultural commodities, including soy and beef.

Despite these commitments, commodity supply chains remain linked to high deforestation rates in the Cerrado in 2020.

Specific soy actors linked to Cerrado deforestation in 2020

734,010 ha were cleared in the Cerrado between August 2019 and July 2020 (reference dates based on PRODES calculation of annualized rates), according to Brazil’s National Forests Monitoring Satellite Program (PRODES). This area, equivalent to 124 times the size of Manhattan, represents an increase of 13.2 percent compared to 2019.

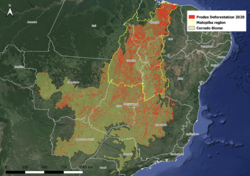

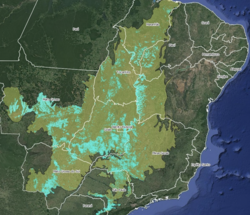

Deforestation on private lands accounted for 489,602 ha, or 66.7 percent of the total Cerrado deforestation in 2020. The main deforestation hotspot was the Matopiba region (Figure 1), comprised of municipalities in the states of Maranhão, Tocantins, Piauí, and Bahia, which holds most of the remaining native vegetation of the Cerrado. Expansion of crop cultivation (including soy) and cattle ranching are the primary drivers of deforestation in the Matopiba region. Large agribusinesses in the region export their goods to international markets like China and the EU. Figure 2 shows the contrast between deforestation on public and private lands in the Cerrado.

Deforestation on Cerrado public lands accounted for 19.2 percent of the total deforestation. Public lands that include rural settlements, indigenous lands, natural conservation units, and federal and state lands accounted for 141,186 ha of the total Cerrado deforestation in 2020. Another 96,608 ha were deforested on lands that are registered as both private and public lands, mainly conservation units that allow sustainable use of the land. This issue of overlapping land tenure categories occurs throughout Brazil.

The remaining 103,212 ha or 14 percent of the total is deforestation in non-designated lands in the biome. These are lands that hold no legal designation. Clarification of uncertainties in land tenure can help to minimize deforestation rates in overlapping areas in the Cerrado.

Key players in soy production have high deforestation risk exposure in the Cerrado

Soybean cultivation is a primary driver of deforestation in savannahs of South America. The Cerrado biome has seen an increase in soy expansion in recent years, causing the loss of biodiversity, high carbon dioxide emissions, and disruption of water systems. Brazil’s soy production has steadily increased in recent years. In 2018/19, the Cerrado biome accounted for 40 percent of the 123 million metric tons (Mt) of Brazilian soy production.

In 2020, a total of 207,813 ha of deforestation took place on farms that have had soy-planted areas since 2017. This area represents 28.3 percent of all Cerrado deforestation in 2020. This figure (28.3 percent) is a conservative estimate given that the deforestation calculations took place on farms with existing soy plantations. The data does not cover farms that started to plant soy after 2017.

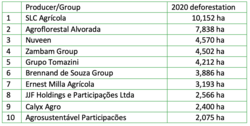

110,333 ha of deforestation in the Cerrado were linked to prominent soy producers. Deforestation falls in farmland owned by producing companies, real estate firms and agribusinesses previously identified in CRR reports. Figure 4 shows a list of the identified top 10 soy producing companies and groups with Cerrado deforestation in 2020.

SLC Agrícola is linked to 10,152 ha of Cerrado deforestation in 2020. SLC Agrícola is the largest listed soybean producer in Brazil, and in 2020, one the top deforesters in the region. In September 2020, SLC Agrícola pledged to halt Cerrado deforestation and move production to only already cleared land. The company said that this policy would take effect after converting 5,000 ha of Cerrado vegetation, a limit which was exceeded by a wide margin in 2020.

SLC Agrícola ’s main customers are Cargill Agrícola S.A. (27.6 percent of revenues) and Bunge Alimentos S.A. (17.9 percent), according to its 3Q 2020 financial statements. As previously reported by CRR, the clearing of Cerrado vegetation on SLC Agrícola ’s farms appears to be in line with Brazil’s Forest Code but in violation of the zero-deforestation commitments of its customers and a large portion of downstream soy-consuming industries.

Approximately 4,570 ha of Cerrado deforestation took place on farms held by Nuveen in 2020. The global asset manager’s publicly available farmland map lists 64 properties in Brazil, of which 44 are in the Cerrado. The list includes soy along with many other crops being farmed in their properties. Nuveen adopted a zero-deforestation policy in 2018 that prohibits acquiring land that has been cleared of native vegetation. The data for Cerrado deforestation in 2020 shows gaps in the implementation of this policy, exposing the asset manager to reputational risks.

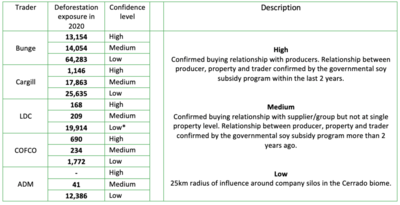

Soy traders face high deforestation risks as their supply chains remain linked to Cerrado deforestation in 2020. The largest soy traders ADM, Bunge, Cargill, LDC, and Cofco operate silos in soy-producing Cerrado regions with high exposure to deforestation in 2020. CRR has identified several traders’ direct suppliers and buying relationships with soy-producing groups in the Cerrado. Figure 6 shows the varying levels of exposure for the main traders and the amount of direct deforestation linked to their supply chains.

As members of the Soft Commodities Forum (SCF), these companies committed to a common framework for reporting and monitoring progress on transparent and traceable supply chains for soy in the Cerrado. However, it remains unclear how the SCF pledges relate to their commitments to exclude conversion of all native Cerrado vegetation and implementation of effective non-compliance mechanisms. None of the traders included in the analysis support the Cerrado Manifesto. The traders’ deforestation policies may be insufficient in mitigating deforestation risk.

Beef and other agricultural drivers of deforestation

Land speculation and the cattle industry are other main drivers of Cerrado deforestation. Many areas in the Cerrado are claimed and then deforested to make room for pastures. The cleared area is used as graze land for the cattle industry and years later sold at a higher price to crop producers, mainly to produce soy but also other crops like maize and cotton. Soy and its commercial derivatives are key ingredients for livestock feeds, supplying the booming meat industry in Brazil and foreign markets. Land tenure insecurities in the Cerrado add to land speculation and increase the land conversion rates in the biome.

Meatpackers directly linked to Cerrado deforestation in 2020

The cattle industry is not only a key driver of deforestation in the Amazon biome but also contributes to Cerrado conversion. JBS had the highest exposure to Cerrado deforestation in 2020 within the top three beef Brazilian meatpackers. JBS, Marfrig, and Minerva have the highest slaughtering capacity among a large number of meatpackers in Brazil. The three companies dominate the cattle industry in the country, and their relation to the Cerrado biome deforestation exposes them to high risks. Based on a small sample of direct suppliers that CRR previously mapped, there was 1,984 ha of deforestation on properties directly supplying to JBS. Similar cases linked Marfrig’s and Minerva’s suppliers to 531 ha and 328 ha of deforestation respectively. This is based on a small sample of suppliers in the Cerrado. The meatpackers’ actual deforestation footprints are much larger. CRR recently reported that since 2008, 20,296 ha have been deforested in the sample of JBS’ direct supply chain, and 56,421 ha in its indirect supply chain. Of land clearing in JBS’ direct supply chain, approximately 71 percent (14,783 ha) occurred in the Cerrado biome, in some cases without the required environmental licenses. The three companies have signed multilateral Cattle Agreements (G4) and legally binding Terms of Adjusted Conduct (TACs). However, TAC implementation has significant gaps and delays and does not cover all Cerrado states. Currently, the majority of retailers monitor their direct beef suppliers, but the indirect farms pose high risks of cattle laundering and leakage from non-TAC signatories.

Retailers exposed to Cerrado deforestation in 2020

Casino Group, Carrefour, and Cencosud beef supply chains are linked to at least 2,189 ha of Cerrado deforestation in 2020. Supermarkets in Brazil are a crucial distribution channel for beef, and 76 percent of beef produced in Brazil is consumed domestically. Among the top five supermarket chains in Brazil, Carrefour Comercio e Industria, Grupo Pão de Açúcar (GPA) (Casino Group as controlling shareholder), and Cencosud Brasil account for a large share of beef sold in Brazil. For this study, CRR traced the origin of sampled beef products sold in GPA stores, Carrefour/Atacadão stores, and Cencosud owned-supermarkets. The study established supply chain links between supermarkets and slaughterhouses in both the Amazon and Cerrado biomes. A sample of direct suppliers to the identified slaughterhouses was determined by using animal transportation permits to calculate the deforestation exposure of these retailers in the Cerrado in 2020. In monitoring deforestation events in 2020, CRR identified 1,237 ha of Cerrado clearing linked to the Casino Group. Similarly, a representative sample of cases linked Cencosud to 605 ha of clearing and Carrefour to 347 ha, all in the Cerrado. Beef products that originate from agricultural expansion areas or deforestation hotspots like the Matopiba region (Figure 1) have an elevated deforestation risk for retailers.

Existing strategies to eliminate deforestation are insufficient to meet companies’ commitments

Companies face multiple business risks from continued deforestation risk exposure. In January 2021, a CRR report aggregated physical and transition risks faced by companies unable to eliminate deforestation from their supply chains. Below is a summary of risks companies operating in the Cerrado face:

-

Physical risks are most relevant for upstream companies such as SLC Agrícola . Native vegetation clearing from soy expansion has disrupted Brazil’s water systems. Increased droughts, erratic river behavior, and changes in rainfall patterns have resulted in productivity losses and could lead to further reduced agricultural suitability of farms in the Cerrado region.

-

Policy and legal risks affect midstream and downstream actors. In the EU, the second largest market for Brazilian soy, a proposal under review aims to reduce the EU’s deforestation footprint through increased regulatory and non-regulatory measures. In France, the “Devoir de Vigilance” law requires companies to implement due diligence plans that prevent adverse human rights and environmental impacts in their global supply chains. In the UK and Germany, legislation for deforestation-free commodity supply chains is also under consideration. In 2020, Casino Group faced legal risks under the France’s Duty of Vigilance law following reports from CRR, Envol Vert, and Mighty Earth that revealed evidence of deforestation risk exposure.

-

Market access risk has the most impact on upstream and midstream actors. The past year has seen an increasing number of companies excluding Brazilian commodities from global supply chains. A public letter from 160 signatoriesof the Statement of Support for the Cerrado Manifesto demanded that soy traders end buying soy from areas in the Cerrado cleared after 2020. European companies and French retailers have also threatened to boycott Brazilian soy. Companies Nestle, VF Corp, and H&M and Norwegian seafood companies have taken steps to exclude Brazilian commodities from their supply chains.

-

Reputational risk significantly affects downstream companies and can evolve into financing risks for midstream companies. Civil society campaigns and journalistic investigations have targeted midstream actors such as Cargill, Carrefour, and JBS. In 2020, Nordea Asset Management excluded JBS from all assets it sells and reports say that HSBC analysts “sounded alarms” over risks of investing in JBS due to deforestation in its supply chain. For downstream companies, CRR concluded that reputation events can impact a company’s value by 30 percent.

Despite increased risks from deforestation exposure, key companies’ commitments and implementation leave gaps that allow for them to be continually linked to deforestation.

Soy producers’ deforestation commitments have varying thresholds and implementation gaps, resulting in continuous direct links to land clearing. SLC Agrícola pledged to halt Cerrado deforestation by the end of 2020, but continued to clear native vegetation. Similarly, Nuveen’s zero-deforestation policy prohibits purchases of Cerrado farmland cleared of native vegetation after May 2009, yet evidence of deforestation is still observed on its properties. Regarding disclosure, SLC reports that it is targeting up to 25 percent reductions of its GHG emissions by 2030. It appears that the company is not on track to meet its target, with Scope 1 emissions trending upward largely due to agricultural emissions. Nuveen conducts audits on its farms and reports on certified soy. However, both SLC Agrícola and Nuveen do not report on progress towards achieving their zero-deforestation commitments and do not disclose actions taken to address deviations from their commitments.

Soy traders’ sustainability policies continue to leave room for deforestation in the Cerrado. As members of the Soft Commodities Forum (SCF), ADM, Bunge, Cargill, LDC, and Cofco have “pledged to eliminate deforestation from their supply chains.” However, with the exception of Bunge, traders’ deforestation policies do not address legal deforestation in the Cerrado and do not have a cut-off date for deforestation. Bunge’s commitment is to achieve “deforestation-free value chains worldwide by 2025,” which “extends to areas where the conversion of native vegetation is legally permitted.” On traceability, the SCF committed to developing a common framework for reporting on soy traceability with an initial focus on 25 municipalities in the Cerrado. The selected municipalities represent 44 percent of Cerrado native vegetation converted to soy. In 2020, the traders reported achieving 100 percent traceability to farm for the 25 municipalities. The SCF reporting framework does not include disclosure standards that require companies to report on suppliers and whether purchase volumes are compliant with the companies’ deforestation policies. The majority of traders remained exposed to increased fires in their sourcing regions in 2020, with Bunge and Cargill having the highest risk. Despite high risk from fires, traders do not have a “no burning policy” that applies to their soy supply chain, only for palm oil.

The top three meatpackers monitor direct supply chains but remain exposed to high deforestation risk exposure in their indirect supply chains. Cattle supply chains are extremely complex, often involving multiple transactions in cattle rearing and production. On average, a single transaction with a direct supplier includes purchases from 15 indirect suppliers. In 2020, JBS and Marfrig announced commitments to monitor their indirect supply chains but progress and effectiveness remain to be seen. Apart from indirect suppliers’ compliance to policies, the quality and timeline of meatpackers’ policies has also come under scrutiny. Through legally binding Terms of Adjustment of Conduct (TACs), meatpackers JBS, Marfrig, and Minerva committed not to buy cattle from illegally deforested areas, indigenous lands, conservation units, or areas with links to forced labor. However, these agreements are limited to Amazon states and do not extend to the Cerrado. On commitment deadlines, Marfrig is aiming for zero deforestation across all biomes by 2030 (2025 for the Amazon). More recently, JBS pledged to eliminate illegal deforestation across all Brazilian biomes by 2030 and achieve zero deforestation across global supply chains by 2035. Prolonged deadlines leave companies exposed to increasing deforestation risk. Along with data presented in this report, investigations in 2020 revealed that all three meatpackers remain linked to deforestation in the Cerrado, with several cases of unauthorized clearing.

The largest supermarket chains in Brazil have varied deforestation commitments, but the majority have limited scope and lack disclosure. Carrefour and Casino are signatories of the Cerrado Manifesto, and both have zero-deforestation commitments and geo-referencing systems to monitor Tier 1 and Tier 2 suppliers. However, Carrefour’s policy implementation and traceability targets apply only to unprocessed beef products, leaving processed or frozen beef products entirely unmonitored. GPA and Cencosud’s policies that aim to mitigate deforestation risk are limited only to the Amazon biome with no actions to halt deforestation in the Cerrado. Other biomes like the Pantanal region of Brazil are equally not covered by most sustainability policies. Casino and Carrefour were recently linked to deforestation in the Pantanal. None of the retailers have a specific timeline for their commitments. Carrefour’s zero-deforestation 2020 deadline was not met, and it has yet to release a new target. It remains unclear how retailers plan to increase indirect supply chain transparency. Only Carrefour discloses Tier 2 supplier traceability, but only for beef (not soy) and it does not disclose progress in monitoring indirect suppliers farther out in its supply chain.

Soy traders, meatpackers, and retailers lack disclosure on how deforestation policies are met in their supply chains. Existing frameworks such as the Sustainable Commodities Framework and recent initiatives announced by meatpackers JBS and Marfrig have emphasized traceability and supplier monitoring. Other traceability initiatives such as the Good Growth Partnership point out that traceability is not an end in itself and ought to be used to enable compliance to companies’ commitments. Increasing focus on traceability overlooks disclosure needed on actions taken by companies across sectors to suspend non-compliant suppliers and uphold their sustainability pledges.

Investors face significant financial risks from continued deforestation exposure

On various levels, investors and banks are involved in financing the top deforesters in the Cerrado, exposing them to material financial risk. Financers can be exposed through loans, bondholdings, shareholdings, and underwriting services. These financial instruments, which connect them to landowners, farmers, traders, meat and soy processors, as well as food retailers, can lead to financial risk. Potential financial losses can be linked to market access risk, operational risk, stranded asset risk, financing risk, and reputation risk.

In a recent analysis, CRR concluded that 74 percent of Brazilian soy and cattle is financed by local financial institutions. From 2013 to 2020, financing of the beef and soy sectors in Brazil totaled USD 100 billion. The total financing is much larger, but these numbers are adjusted to account only for the share of soy and cattle activities in Brazil. According to the Forests & Finance database, loans totaled USD 82 billion, underwritings USD 13 billion, shares USD 5 billion, and bonds USD 1 billion. Foreign financial institutions provided (an adjusted) USD 14.5 billion to the beef sector and USD 11.2 billion to the soy industry. Santander, Rabobank, HSBC, and JPMorgan Chase, which all have policies to halt deforestation, are among the top-25 financiers. policies to halt deforestation, are among the top-25 financiers.

Many financial institutions are signatories of the Cerrado Manifesto and have policies which are focused on halting deforestation. Financial institutions based in the EU or investing in EU companies with supply chain links to deforestation will face much more stringent regulation on deforestation. The Cerrado Manifesto calls for a halt deforestation and native vegetation loss in the Cerrado. Currently, investors representing USD 6.3 trillion of global investments have signed the Statement of Support for the Cerrado Manifesto, which has also been signed by leading Fast Moving Consumer Good companies, including retailers. In Europe, the Sustainable Finance Disclosure Regulation (SFDR), which went into effect March 10, 2021, is expected to lead to increased transparency on sustainability risks and questions about the financing of commodities that lead to environmental damage. It forms part of the EU’s wider Sustainable Finance Framework, which is backed by a broad set of new and enhanced regulations that will apply across the 27-nation bloc. The SFDR is aligned with the Sustainable Finance Action Plan, which aims to promote sustainable investment and a new EU Taxonomy to create a level playing field across the whole EU. With a mandatory EU system of due diligence for supply chains, these regulations are embedded in a European Green Deal environment.

In the farm and landowner group of top deforesters, SLC Agrícola and Nuveen are financed by foreign financial institutions with forest policies. JJF Holding, meanwhile, lacks financial transparency. SLC Agrícola’s main customers are Cargill and Bunge and its main businesses are farming and landownership. The company is majority owned by SLC Participações SA, with several European investors with zero-deforestation policies holding minority stakes. In recent years, the Norwegian Government Pension Fund has sold its stake in the company. However, APG is the sixth largest external shareholder in SLC Agrícola with an (adjusted) exposure of USD 12 million. Forests & Finance shows that the company is mainly financed by Brazilian entities.

Nuveen, TIAA’s asset manager, is a landowner in Brazil. The lack of transparency in Nuveen’s complex web of investments may put investors in Nuveen’s funds in conflict with their climate change policies, leading to reputation risks. Lenders include BNP Paribas, Santander, Rabobank, and HSBC, and farmland fund participants with policies include AP2, Caisse de Dépôt, and ABP.

JJF Holding is a privately-owned company which lacks transparency. No loans have been found. Financial risk can be identified for investors in Bunge and financers of ALZ Grãos and Cargill, which have business relations with JJF Holding. Cutting business ties with JJF Holding would protect (reputation) value for financers of these soy traders.

Of the soy traders, ADM, Bunge, Cargill, LDC/Amaggi, and Cofco are the players most linked to deforestation in the Cerrado. These traders are financed by international investors. Shareholders of the listed entities ADM and Bunge face financial risk. Bunge’s exposure in<