South African farmers offered land in Angola, Uganda

- Bloomberg

- 09 October 2009

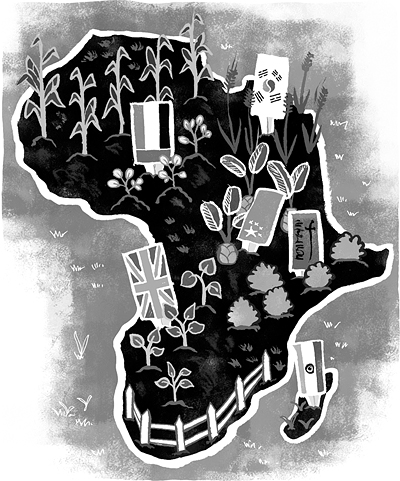

South African farmers have been offered land for agriculture in Angola and Uganda and the government is also in talks with the Democratic Republic of Congo, Zambia and Southern Sudan.