The return of the capitalist of chaos: Philippe Heilberg and a US$1 billion carbon deal between the Democratic Republic of Congo and dClimate

- REDD-Monitor

- 09 February 2024

“I’m there to make money,” Heilberg says. This time with carbon credits.

“I’m there to make money,” Heilberg says. This time with carbon credits.

A climate startup co-founded by a businessman behind a botched land deal for 400,000 ha in South Sudan has signed a deal to generate $1 billion of carbon credits in the DRC.

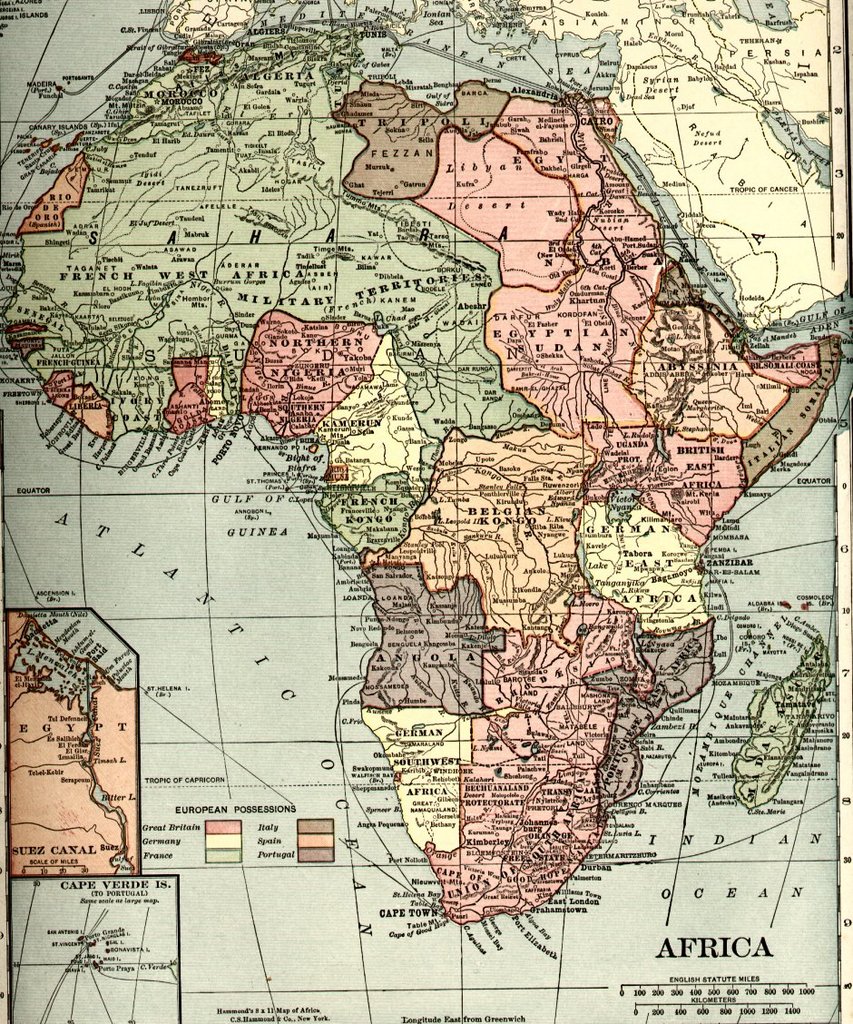

On Al Jazeera’s talk show South2North, Redi Tlhabi debates the new scramble for Africa with former Mozambican president Joaquim Chissano, Nigerian politician Nkoyo Toyo and Philippe Heilberg, a land investor from the US.

An ex-Wall Street banker jets off to South Sudan to show how investors are rushing to Africa in a modern-day land-grab. Watch Al Jazeera 'Witness'.

Investors, such as Jarch Management and Nile Trading and Development, are buying up huge tracts of fertile land in Southern Sudan.

Four months before South Sudan becomes an independant nation nine percent of the country has been targeted by investors, a Norwegian People's Aid report reveals.

As African leaders, many out to line their own pockets, sign away their people's land to foreigners, the continent's people face not having enough food to eat.

A move by Madagascar's army-backed leader to nix a huge South Korean farming deal has exposed the risks of such ventures in Africa.

Accaparement des terres - cas du Soudan - par AGTER

Because of the political sensitivity of the modern-day land grab, it is often only the country's head of state who knows the details. Der Spiegel investigates.

Regierungen und Investmentfonds erwerben in Afrika und Asien Ackerland, um Nahrungsmittel anzubauen – ein lohnendes Geschäft, weil die Preise rasch steigen. Das Milliarden-Monopoly führt zu einem modernen Kolonialismus, dem sich viele arme Länder notgedrungen unterwerfen.

It's a tsunami of land deals and, as all of the experts who have studied the phenomenon have agreed, no nation is truly prepared for its implications.

|

CAR offers land ownership using cryptocurrency

|