Feeling hungry, SWFs ramp up food and agriculture purchases

- Institutional Investor

- 05 Mar 2015

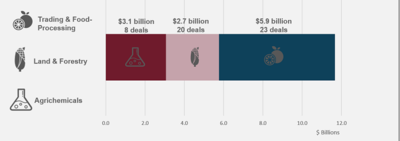

Sovereign wealth funds’ appetite for agriculture and fertilizer companies is growing as concerns about stable food supplies rise.

Sovereign wealth funds’ appetite for agriculture and fertilizer companies is growing as concerns about stable food supplies rise.

Los Grobo does not own a single shovel or acre. Instead it leases machinery and land from others. This outsourcing model is now used for nearly 60% of farmland in Argentina.

Adecoagro will assist FMN in the management and development of Kaboji Farm, one of the largest commercial farms in Nigeria, comprising 10,000 ha of maize and soybean.

Located in the heart of sunflower country about 350 km from the Buenos Aires port, CHS AGRO will grow and process sunflower kernel and in-shell products for global marketing and distribution by CHS. Each company will hold 50 percent ownership in CHS AGRO.

Warren Buffett's Berkshire Hathaway has initiated a position in Archer Daniels Midland when it is anticipated that companies like ADM and Bunge will seek out targeted acquisitions of global farmland in order to both expand and diversify operations

Hedge fund billionaire George Soros made a fortune betting against the British pound in 1992 and was accused of doing the same against the Thai baht and the Malaysian ringitt in 1997. Today Soros is making a killing buying and selling farmland in South America.

Adecoagro realised more of the substantial gains within its 283,000-hectare landbank by selling one of its Argentine farms in a deal valuing it at 11 times the purchase price a decade ago.

Adecoagro, the South American farm operator backed by George Soros and Dwight Anderson, said that growth in the value of its huge land portfolio slowed to 5.6%, fuelling concerns over the impact of Argentine curbs on foreign investors.

Adecoagro, which owns nearly 300,000 hectares of land in Argentina, Brazil and Uruguay, said it had sold its San Jose site for $1,212 per hectare, compared with a purchase price of $85 per hectare in 2002.

Adecoagro, the agricultural company that counts George Soros as its biggest investor, is giving potential buyers the chance to get a hold of farms in Brazil and Argentina at a 36 percent discount to its net assets.

Fertile soil and good water supply – but lagging development – present a compelling opportunity for agriculture investors, finds Stephanie Schwartz-Driver

Lo hizo a través del fondo de inversión Adecoagro, que cuenta con emprendimientos agrícolas y agroindustriales en prácticamente toda Sudamérica. En Santiago del Estero ya tenía campos en el departamento Belgrano, donde produce oleaginosas y cereales. El valor de la hectárea en esa zona ronda los 7 mil dólares.

|

Obsolètes, les réformes agraires ?

|