Knowledge at Wharton Today | March 9, 2011

Record-high food prices are driving new economic pressures — beyond the obvious surge in costs to consumers.

In Brazil, for example, officials look set to introduce new rules on foreign government-backed investments in farmland, a move that would extend sweeping foreign-ownership restrictions adopted last year.

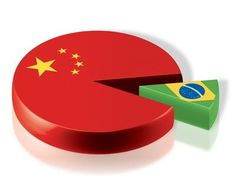

While there is some talk that Brazil could scale back slightly some of the very strict new rules, officials there appear highly concerned about who controls the country’s natural resources, and it is understood that much of the worry centers on the Chinese.

Brazil’s growing concerns reflect a larger rethinking on ownership of commodity production underway globally. Resource-rich developing countries, which once saw foreign direct investment in natural resource development as an unquestionable good, now take a more nuanced view. They are beginning to question whose interests are best served by foreign investments in domestic natural resources and commodity production.

Last year, Brazil laid down rules that prevent companies that are more than half foreign owned from holding more than about 12,000 acres of farmland. Newly proposed rules, however, would restrict governments, state-owned companies and speculators from owning farmland, too. Specifically citing state-owned companies is widely understood as a not-so-subtle stab at Chinese companies, many of which include government funding and control.

Regarding those new rules, Brazil’s agriculture minister, Wagner Rossi, was quoted in the Financial Times as follows: “Some of these countries are great partners in other areas, but having them buying land in Brazil creates some sort of sovereign risk for us. This is not part of our plan and we are not going to allow that.”

At the same time, other recent remarks by Rossi suggest that rule tightening may not be entirely straightforward, notes Wharton management professor Felipe Monteiro. He points out that Rossi also will submit a technical paper shortly that will rationalize all farmland ownership restrictions. Monteiro’s reading of the latest proposals: More than taking any “concrete measure, Rossi only announced that Brazil is taking a close look at the situation and will keep updating its legislation on the matter to protect itself from speculation.” Basically, Brazil is tracking developments, which Monteiro says “is appropriate and shows how interconnected the world is today.” Until the future legislation is drafted, “no one can know for sure how it will distinguish property speculators and foreign funds from foreign investors with real productive projects for the sector.”

Still, are the new agricultural land rules ultimately a backlash against Chinese investment, as some suggest?

Brazil’s actions are part of a growing concern over the politics of natural resources worldwide, according to Wharton management professor Witold Henisz. These concerns are very different from those fueling the outsized protections that developed countries historically have heaped on their own agricultural sectors. Europe has a huge subsidy program, the Common Agricultural Policy (CAP); the U.S. offers substantial price support and other incentive programs; and Japan’s protection of rice farmers is legendary.

But there is a big difference between those programs and efforts by developing countries today. “U.S., E.U. and Japanese farm subsidies target job preservation and, in the Japanese case, ensure local production to meet local demand,” Henisz says. Brazil’s agricultural rules and Argentina’s export restrictions of the past few years, plus growing concern in Africa, “point to a different political incentive — not maintaining jobs or influencing the location of production but rather influencing the nationality of production and of consumption of domestically grown crops as well as keeping prices down domestically by ensuring exports abroad are regulated.”

While Brazil and African countries used to welcome Chinese investment “with open arms,” they now wonder “whether that investment serves their interests or those of their foreign owners,” Henisz says. “The lack of integration of many Chinese investors into local communities and markets only accentuates that suspicion. For the Chinese to truly benefit from their overseas investments in natural resources, they will have to develop a political and social strategy to demonstrate that the local population stands to gain.”

Just as U.S. and European Union oil and mining companies found that strategic corporate social responsibility was good policy, “the Brazilian policy announcement, together with recent protests against mining companies in Zambia, serve as a warning call to China that the era in which they faced few questions by virtue of the alternative they offered to Western investors is over. Now their nationality is at issue. Their strategic goals are being questioned.”

So, it’s a new world for Chinese and other large multinational corporations bent on acquisition – at least when it comes to farmland. As developing countries adopt a new attitude, large-scale foreign-direct investors must, too.

They need to work up a new a political strategy, Henisz says. “They are developing the natural resource sectors, including agriculture and the infrastructure to ship it home, but they need to demonstrate these investments and benefits are of broad interest to Brazil and Africa.”

The alternative: “a repetition of the colonial mistakes [within] in two decades instead of two centuries.” And while the Chinese government adapts quickly, “Brazilian and African politics are so foreign to them that I am skeptical about their ability to learn and implement responses rapidly enough to avoid a growing backlash.”

Brazil sets up new roadblocks for agricultural investments – especially from China

-

Wharton

Wharton

- 09 Mar 2011

Who's involved?

Whos Involved?

Carbon land deals

Dataset on land deals for carbon plantations

07 Oct 2025 - Cape Town

Land, life and society: International conference on the road to ICARRD+20

Languages

- Amharic

- Bahasa Indonesia

- Català

- Dansk

- Deutsch

- English

- Español

- français

- Italiano

- Kurdish

- Malagasy

- Nederlands

- Português

- Suomi

- Svenska

- Türkçe

- العربي

- 日本語

Special content

Archives

Latest posts

-

CAR offers land ownership using cryptocurrency

- IT Web

- 23 June 2025