Zawya | 29 Jun 2011

Much like its other needs, the Gulf states food demands are rising. Except that the region's local agricultural production is abysmal - therefore, a streamlined and comprehensive food supply programme needs to be put in place to ensure a steady supply. Most of the Gulf states have embarked on their own strategies and looking to purchase agricultural land to meet future demand.

The GCC's food import bill stood at $25.8-billion in 2010, and will more than double to reach $53.1-billion in 2020, according to an Alpen Capital report.

Saudi Arabia will spend the most on imported food with $35.2-billion by 2020 from its current spend of $16.8-billion.

However, Qatar and the UAE will see their food consumption rise the fastest, with 9% compounded annual growth rate (CAGR) till 2020, compared to the other four GCC states' average CAGR of 8%.

The growth comes on the back of exploding population and rising standards of living - the Gulf's population is set to rise from 40.6-million to 50-million, according to Alpen Capital.

"Meeting this increasing demand for food arising out of the growing consumption is both a challenge for the GCC governments and an opportunity for private sector players to expand with in the market," says Alpen.

The key issue for the Gulf is food security. According to the United Nations Food & Agricultural Organization (FAO), only 1.7% of land in Saudi Arabia is arable. With water a precious resource, Saudi Arabia and other Gulf states are investing heavily in agricultural land across the world.

For example, Saudi Arabia is looking to phase out wheat production as it takes up previous water resource and at the same time double its wheat reserves from six months to one year. The country expects to buy 100% dependent on wheat imports by 2016, according to the Ministry of Agriculture.

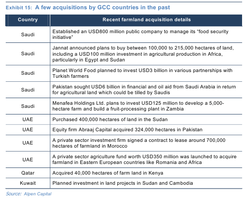

Given the seriousness of building food reserves, Saudi Arabia has launched an $800-million company to manage its food security initiative. The Saudi company Jannat plans to buy up to 215,000 hectares of land in North Africa. Meanwhile, Pakistan is looking to secure financial aid from Saudis in return for agricultural land.

Similar arrangements between oil-rich Gulf with agriculturally rich poorer countries are being struck elsewhere as well. The UAE has purchased 400,000 hectares of land in Sudan, while Qatar has acquired 40,000 hectares of farm land in Kenya.

And non-state players are also getting into the act. Abraaj Capital, the region's largest private equity firm, bought 324,000 hectares in Pakistan, and Prince Waleed's Kingdom Holding recently bought 10,000 hectares of land in southern Egypt.

These foreign acquisitions are not without their controversy as NGOs often see it as a 'land grab' that deprive the indigenous populations of the food. Therefore such food agreements have major risks attached to them.

"Disruption in food imports, either due to policy restrictions by exporting countries or natural calamities, has always affected the region significantly. Also, food imports are significantly costlier than the local produce," says Alpen. "It is therefore important for the governments in the region to strive to achieve food security in order to reduce their dependence on imports."

While there has been some effort to encourage local agricultural production, the demand is rising at a much faster clip, making it a losing battle for the Gulf states.

According to the FAO, 1.4% of total land area in this region is arable, with the figure varying from a high of 2.9% for Bahrain to a low of 0.1% for Oman.

"Another problem is the low level of water resources--the agricultural sector consumes most of the extracted fresh water, although the percentage of consumption varies from country to country. Due to the poor water resources, the contribution of agriculture to the overall GDP in the region is low," says Alpen.

Rising Food Prices

Like the rest of the world, the Gulf states are also facing rising food prices. Indeed food inflation was one of the primary triggers that led to the Arab Spring, mostly in poorer countries like Tunisia, Egypt and Morocco. But while it toppled governments in poorer Arab countries, high food prices will not spare richer countries either.

A combined study by the Organization for Economic Co-operation and Development (OECD) and FAO expect commodity prices to rise in real terms especially 20% higher for cereals (maize) and up to 30% for meats (poultry), over the 2011-20 period compared to the last decade.

"Increases in commodity prices are now moving down the commodity chain into livestock commodities. As higher prices for commodities are passed through the food chain, recent evidence indicates that consumer food price inflation is currently rising in most countries, contributing to higher aggregate consumer price inflation," says the study published earlier in June.

"This raises concerns for economic stability and food insecurity in some developing countries as the purchasing power of poorer populations is reduced."

The key factors driving price volatility include:

- Weather and climate change - The most frequent and significant factor causing volatility is unpredictable weather conditions, says the OECD-FAO report.

- Energy prices - Increasing links to energy markets through both inputs such as fertilizer and transportation, and through biofuel feedstock demand, are transmitting price volatility from energy to agricultural markets. The long-term trend of energy prices remain on the high side.

- Exchange rates - Currency movements have the potential to impact food security and competitiveness around the world. Many analysts blame the plunging dollar as a key reason for rising prices.

- Increasing demand -With per capita incomes rising globally and in many poor countries expected to increase by as much as 50%, food demand will become more inelastic such that larger price swings would be necessary to affect demand.

- Resource pressures - Higher input costs, slower technology application, expansion into more marginal lands, and limits to double-cropping and water for irrigation, are limiting production growth rates.

- Trade restrictions - Both export and import restrictions amplify price volatility in international markets.

- Speculation - "Most researchers agree that high levels of speculative activity in futures markets may amplify price movements in the short term although there is no conclusive evidence of longer term systemic effects on volatility," notes the OECD report.

Major Importers

Given this global backdrop, the Gulf states find themselves dependent heavily on food imports - which is a key risk that needs to be managed. For example, the UAE imports 80% of its meat consumption, 84% of dairy and milk and 63% of vegetables. Qatar imports 93% of its milk and dairy consumption, 80% of vegetables and 99% of cereals. Other Gulf states have similar figures, reflecting the crippling dependence on food imports.

Given the growth trends, many food companies in the Gulf are taking the M&A route to become larger players. Apart from regional acquisitions, these companies are also eyeing international investments.

Saudi-based Almarai is an early and aggressive practitioner of M&A in the GCC and abroad, acquiring several companies in the past, especially during 2007-2009, says Alpen. Over this period, Almarai spent over USD500 million acquiring multiple target companies in the food sector, including HADCO for around USD253 million in 2009. The Al Marai board also recently approved the expansion of its poultry business with a $1.1 billion investment.

Savola, the other large player in the region's food sector, too has adopted an aggressive M&A strategy, making a string of acquisitions in Saudi Arabia and abroad. Major acquisitions of Savola include Turkish oil Company Yudum in 2008, Saudi Arabia based retail Geant and Giant stores in 2009, notes Alpen. Besides these, Savola also holds strategic non-controlling stake in several GCC food companies, including Almarai.

"Given strong growth potential, the region is likely to see a buzzing activity in the M&A space, driving further consolidation in the food sector. Broader strategic objectives such as concentric diversification, market share expansion and reach in the domestic and regional markets are expected be the key factors fuelling such acquisitions," says Alpen.

This is especially true in Saudi Arabia, easily the region's largest market, which makes up 66% of all food imports in the Gulf.

According to the Economist Intelligence Unit (EIU), the Saudi food, drinks and tobacco sales is expected to rise 8.4% CAGR from 2009-2014, to reach a total of $56-billion.

Saudi Arabia's retail market volume is projected to expand by 22% between 2011 and 2015. Further, in terms of value, food is likely to account for more than half of retail spending. The EIU expects Saudi's retail sales to increase from an estimated $67.50-billion in 2010 to $105.90 billion by 2015.

Total food expenditure is likely to expand with demand for high-value foods such as meat, confectionery, convenience and processed foods growing.

Meanwhile, EIU estimates the country's 2010 GDP per capita at $22,842 and foresees it increasing to $27,852 by 2015.

"Hefty incomes will see Saudi consumers spending a greater portion on fast-moving consumer goods (FMCGs) which, in turn, will likely boost per capita food consumption and mass grocery retail sales," says Taib Research in a report on Savola. "Furthermore, the country's F&B industry is likely to turnaround with foreign investors seeking potential joint ventures and investment opportunities. However, a major concern for food companies is the spike in global food prices. Saudi Arabia's annual inflation rose to 4.8% in April 2011, driven by higher food and transport costs."

The major opportunities in the food sector are also matched by the threat that needs to be managed by the Gulf governments. While by no means insurmountable, the food supply management skills need to be further honed given the rising consumption and changing dietary habits of the regional and expatriate populations.

Conclusion

While the Gulf states are unable to raise local production of many basic food items to match rising demand, the food sector is not without its success stories. Listed and un-listed companies such as Rajhi, Masafi, Al Marai, Sadafco, Aujan, Nadec, Agthia Group, Sanabel, Al Rabie, Halwani and Al Watania Dairy, have demonstrated that there are plenty of opportunities on the regional food sector.

Alpen's study of 20 publicly traded Gulf food, agriculture and dairy companies suggest robust growth of 17% over the past three years.

"We contend that food companies in the GCC have huge growth potential, given the strong projected population, favorable consumption trend and incomes in the region," notes Alpen in its study. "This along with easing of political crisis in the region is likely to boost valuations further up."