Wheat price skyrockets and wheat farmland investments stand to benefit

As we discussed in previous articles here and here, we believe the case for investing in farmland - and certainly the agriculture sector more broadly - is extremely compelling. Large investors from Jim Rogers to the massive American pension fund TIAA-CREF are allocating investments to the farmland asset class.

Now, we have just seen a further indication of the long-term upwards trend of everything related to the agriculture sector, as the price of wheat soared 17% in one week due to continuing problems with drought in Russia and Ukraine. Interestingly enough, this reminded us of a bold prediction a few months ago by Saxo Bank. Saxo Bank is an innovative Danish bank, and at the beginning of each year they put out a list of they call "Outrageous Predictions." For 2012, one of their "outrages" was that the price of wheat would double this year. Whilst initially paying this no heed, it suddenly seems like a prediction - however unlikely still to occur - that should be on investors' radar screens.

One way to play this run-up in wheat prices is through direct investment in farmland. While farmland prices are already quite high in England, Europe and the United States, outside of the wealthier countries farmland starts from a much lower price base. This means higher income payments are on offer as well as greater upside potential in capital gains. As wheat is perhaps the most critical food crop in the world, many of the farmland investments available actually have wheat as their core crop along with other grains.

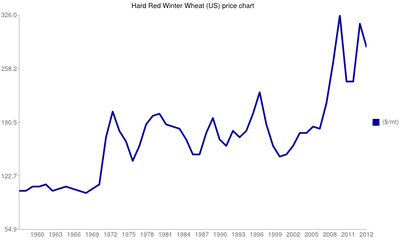

While farmland provides regular income and a certain stability, it is also of course quite illiquid. At the other end of the scale, for those looking for a wheat trading option accessible through an online trading account, the ELEMENTS MLCX Grains Index TR ETN (GRU) has an exposure to wheat of 47%, the highest by far of any of the agriculture ETFs or ETNs we are aware of. For those interested in an historical perspective, below is the price of wheat since the year 1960 (note, it only runs to April 13 of this year, so it does not include the huge spike last week).