Australian Financial Review | 24 September 2012

China targets dairy industry

Angus Grigg Shanghai and James Massola

China’s giant sovereign wealth fund is looking to make its first significant investment in the Australian dairy industry, as it tries to lock up food supplies for its growing middle class.

In a potential test case for foreign investment laws, China Investment Corp, which is estimated to have $US190 billion to invest outside its home market, sent four executives to Tasmania this month.

They inspected two large dairy operations in the state’s north which have a combined value of more than $200 million and significant capacity for expansion.

After the inspection, Premier Lara Giddings held a lengthy meeting with CIC’s president, Gao Xiqing, during a visit to Beijing and declared the sovereign fund was “particularly interested in exploring agricultural opportunities” in Tasmania. “We would welcome a Chinese investment in our dairy industry,” she said in a speech in Shanghai later.

China is increasingly looking towards Australia in its battle to provide safe and secure sources of food for its 1.3 billion people, who are demanding higher quality products as their incomes rise.

Only last year China overtook the US as the world’s largest importer of food, after shipments rose 34 per cent. CIC’s interest comes as a report by Rabobank forecasts food prices will hit a record high next year, as the world returns to a period of “agflation” not seen since 2008.

Foreign investment tensions renewed

But foreign investment in Australian farm land remains a sensitive issue, and flared up again recently when China’s Shandong Ruyi won approval to buy Queensland cotton farm Cubbie Station.

The dairy deal, which would attract Foreign Investment Review Board scrutiny, could also re-open tensions in the federal Coalition over foreign investment, a week after Opposition Leader Tony Abbott and his deputy, Julie Bishop, warned colleagues about “freelancing” and ill-discipline.

Nationals Senate leader Barnaby Joyce, who led opposition to the Cubbie sale along with Nationals senator John Williams, declined to comment on Sunday, but Senator Williams questioned whether the dairy deal was in the national interest.

“I’d have to ask what is in the national interest in selling off milk processing to the Chinese government,’’ he said.

Liberal senator Bill Heffernan also took issue with the potential deals, arguing: “What we have to decide in the longer term is whether we allow the proliferation of sovereign money from a non-market currency, and whether that is going to in any way damage our long-term revenue base, because of the way the current tax laws are.”

Tasmanian dairies in the spotlight

An investment from a sovereign wealth fund like CIC has the potential to be even more politically fraught, although in 2011 a subsidiary of China’s state-owned COFCO won approval to purchase Queensland’s Tully Sugar.

The CIC executives are known to have spent two days inspecting the Little Lion dairy operation, which is on the market for around $80 million. The privately owned group also has a 20 per cent stake in the Smithton milk processing plant, which only came on-line last week at a cost of $80 million.

The CIC executives spent a further two days inspecting Australia’s largest diary farm at Woolnorth, owned by New Zealand’s Tasman Farms, which owns 98.42 per cent of the Van Diemen’s Land company, operator of Woolnorth.

The company is looking for $180 million in additional capital to expand but some believe it could be a seller if it fails to secure the additional money.

Van Diemen’s Land chief executive Michael Guerin was tight-lipped when contacted by The Australian Financial Review but confirmed the company was in the final stages of discussions about the capital raising with several interested parties.

“We came out 12 months ago and said we want to raise up to $180 million to complete our broader development program, which includes expanding our dairy operations on the historic Woolnorth property,’’ he said. Asked if the company had contacted the Foreign Investment Review board, Mr Guerin said: “We have an equity raising program under way that recognises all the laws and requirements of this country.

“Depending on the size of the equity raising and who might participate, we have many legal considerations to successfully completing it. We have been in contact with all the relevant state and federal authorities.”

Mr Guerin said the company already supplied milk to New Zealand-based dairy giant Fonterra, one of the largest suppliers in the Chinese market.

CIC looking to partner

CIC would be expected to partner with a local or foreign company if it participated in any deal, as it does not wish to own more than 49 per cent of any business and has no operational capacity.

Potential Chinese partners could include the country’s largest dairy operator, Wahaha Group, or Mengniu which has extensive interests in ice cream, milk and yoghurt.

The chairman of Wahaha, Zhong Qinghou, is known to have visited Tasmania recently and has shown some interest in the Little Lion operation.

He had previously tried to make an investment in the West Australian dairy industry but could not find farms of sufficient scale.

Ms Giddings’ visit to China was partly aimed at promoting the $400 million expansion of irrigated farmland in Tasmania, which should result in the size of the state’s dairy herd doubling over the next decade.

Politicians ask What’s in it for Australia

But Senator Williams asked: “What the hell is in it for Australia? Why are overseas governments buying our businesses when Australia is getting out of business? What’s in it for the long-term advantage of Australia?”

He said that Treasurer Wayne Swan should “have a look at this and tell Australia why this would be in the national interest, or will this be another 5pm Friday night announcement?” This was a reference to the timing of the Treasurer’s decision to green-light the sale of Cubbie Station.

And Senator Heffernan said the foreign takeovers act needed to be brought up to date from the 1970s, and asked whether the produce of the dairy farms would bypass the market and be returned directly to China.

“In the event that there is a proliferation of acquisitions that bypass the commodities market, you will distort the commodities market,’’ he said.

“This isn’t about xenophobia, we have been allowing foreign investment for 100 years – the issue is protecting our revenue base.”

International interest beyond China

David Williams, an investment banker from boutique firm Kidder Williams, confirmed he had been appointed to sell the Little Lion operation. “I expect to sell the package to an Asian buyer interested in a fully integrated solution from farm to factory. While the Chinese are and should be interested, I expect Indian, Brunei, Brazilian and Singaporean interests to be quicker in making decisions,” he said.

Foreign-produced dairy products are highly sought after in China after a series of contamination scandals significantly lowered confidence in local products.

Chinese consumers are also drinking more milk as their incomes rise and the health benefits of dairy products become more widely known.

If CIC was successful in making an investment in an existing dairy farm then it might take part in future stages of Tasmania’s irrigation expansion.

Irrigation part of Tasmanian attraction

Despite accounting for just 1 per cent of Australia’s landmass, Tasmania has 12 per cent of the country’s fresh water. It is also in the unique position of expanding its irrigated land at a time when most other states are buying back water licences in an effort to improve the health of stressed river systems.

Tasmania won $140 million in federal government funding and $80 million in state money to develop its irrigation infrastructure.

The government-owned Irrigation Tasmania has completed the building of four schemes, has commitments for another three which are under construction and is looking for private funding for a further two schemes.

In the longer term Tasmania could open up an additional six irrigation areas worth $184 million.

“There is plenty of high surety water and plenty of high quality land,” said the chief executive of Irrigation Tasmania, Chris Oldfield.

Dairy industry welcomes foreign interest

Mark Smith, executive officer of DairyTas, the Tasmanian service delivery arm of Dairy Australia, welcomed the potential deal and said no distinction should be made about which country the investment came from.

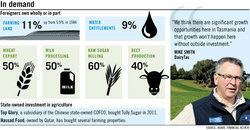

“We think there are significant growth opportunities here in Tasmania and that growth won’t happen without outside investment,’’ he said.

“The bottom line is that dairy farming activity has a significant local and regional benefit here, even if it is overseas-owned. We shouldn’t shy away from having an appropriate level of overseas investment here.”

Chinese state-owned and private companies have increasingly turned their attention to Australian agricultural assets in recent years.

Apart from Cubbie Station, the Shanghai Xhong Fu Group is bidding to develop 15,000 hectares of irrigated farmland, as part of the Ord River expansion in West Australia.

Trade Minister Craig Emerson has also commissioned a joint study with the Chinese government on how the two countries can work together to develop agricultural land in northern Australia.

The report is likely to be released in conjunction with the federal government’s Asian Century White Paper, which is expected to be made public shortly.

It aims to detail what laws or regulations would need to change for Chinese companies to open up new farmland in Northern Australia.