Wall Street Journal | 13 November 2012

By PETER WONACOTT

JOHANNESBURG—Carlyle Group LP has joined the private-equity crowd in Africa.

The buyout specialist on Wednesday is expected to unveil the first investment of its new Sub-Saharan Africa Fund, one of many looking for capital and deals on the continent. Its foray into Africa represents one of the continent's bigger private-equity investments in recent years. Carlyle is part of a small group of investors that will inject $210 million into Export Trading Group, a Tanzania-based agricultural company that sources commodities from Africa's small farmers and sells those goods to China, India and elsewhere.

[image]

The Pembani Remgro Infrastructure Fund, a South Africa-based private-equity firm, will join Carlyle as well as another partner in the investment, Standard Chartered PLC's Africa Private Equity division. Standard Chartered invested an additional $74 million in Export Trading Group earlier this year. The companies declined to disclose the size of their respective stakes but said the transaction, expected to close this month, would represent a minority investment.

The investments, and Carlyle's nascent Sub-Saharan Africa Fund, targeted at $500 million, show how private-equity firms are trying to position themselves to tap into the continent's new consumers as well companies that are expanding on the back of demand for food and energy from the rest of the world. Competition among global rivals is heating up in Africa, as investment returns diminish in more developed parts of the world.

Blackstone Group LP has invested with other partners in the $900 million Bujagali hydroelectric dam in Uganda, a project that helped alleviate the East African nation's chronic energy shortages. Blackstone's stake is valued at about $120 million, and the U.S. investment firm has agreed to limit its profits on electricity sales to 19%.

Meanwhile, KKR & Co. recently hired Kayode Akinola, a former banker in Europe and deal maker with Africa-focused and London-based private-equity firm Helios Investment Partners LLP, to find investment opportunities in the region.

Africa's prospects appear more appealing than in the past, largely because it is expanding faster than most regions outside Asia and the Middle East. The continent's young people—the average age is 19—are making their way to the cities and stoking consumer demand. More African countries also have become better-governed democracies, providing some political ballast that wasn't present before.

"Political and economic stability are the bedrock of private-equity capital," said Genevieve Sangudi, managing director of the Carlyle Sub-Saharan Africa Fund. "We're here for the long haul."

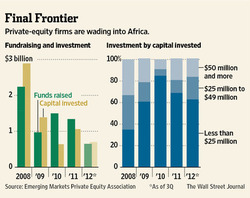

Carlyle is following others into what remains a tiny market. Only $700 million in private equity was invested in Africa through the third quarter of 2012, according to Emerging Markets Private Equity Association, a Washington-based group that tracks global industry trends. That figure lags behind the $1.1 billion invested in 2011. The vast majority of private-equity deals done in Africa are less than $25 million.

Yet the continent's growth—the International Monetary Fund estimates sub-Saharan Africa's economy will expand 5% this year—is giving rise to African multinationals, such as the Export Trading Group. The company trades 25 different commodities, from cashews to coffee, and is set to double sales. It earned $884 million in revenue in the fiscal year ended March 31 and projects that figure will rise to $1.5 billion in the current fiscal year.

Among other things, Export Trading Group expects to use fresh capital from Carlyle and others to add to warehouses in Asia, where it buys rice and fertilizer. It also wants to expand transport and distribution networks in Africa to get more farm-grown food onto the continental and global markets.

"Agricultural consumption is increasing significantly," said Ketan Patel, managing director of Export Trading Group. "People are eating more as they become more affluent."

—Ryan Dezember in New York contributed to this article.

Write to Peter Wonacott at [email protected]

----

Carlyle finds cashew group to its taste

Financial times | November 13, 2012

By Jack Farchy and Emiko Terazono in London

Carlyle is to lead a $210m private equity investment in an African agricultural commodity merchant that is one of the world’s largest traders of cashew nuts, the latest in a wave of transactions to sweep the agribusiness industry.

The purchase of a minority stake in Export Trading Group will give the Tanzania-based company an enterprise value of more than $1bn, according to people familiar with the deal. It is currently owned by its management.

Alongside Carlyle, the Pembani Remgro Infrastructure Fund, a South African private equity fund, Standard Chartered and ETG’s management will also contribute to the $210m cash injection. Standard Chartered has invested $74m in the company.

The deal comes amid a wave of dealmaking among agricultural traders as they seek to profit from rising trade in food commodities due to strong demand in emerging economies such as China.

This year, several multibillion-dollar deals have been announced, including Glencore’s purchase of Viterra of Canada for more than $6bn, Marubeni’s acquisition of Gavilon for $5.3bn and ADM’s near $2.8bn offer for GrainCorp of Australia.

ETG, which has operations in 30 African countries, specialises in trading niche commodities such as sesame seeds, cashew nuts and pulses. With Singapore-listed Olam, it says it is among the world’s top cashew nut traders.

The capital injection will be used to fund a programme of investment in processing facilities that produce higher-value products such as vegetable oils, flour or ground coffee. The company’s net profits rose 44 per cent to $47.3m in the year to March.

Ketan Patel, managing director of ETG, said the company was well positioned to capitalise on growing strains in global food supplies.

“The last place that has huge tracts of lands that could potentially feed this population of 10bn we are expecting in the next few years is Africa,” he said. “We believe Africa is becoming a more and more important player in the agricultural markets globally.”

Carlyle’s investment is the first by its new sub-Saharan Africa fund, which is expected to raise about $500m. Marlon Chigwendge, managing director of the fund, said that the investment was a bet both on rising demand for food commodities and on African growth.

“The broad story of growth across Africa is there and it is not just a commodities story, it is an internal domestic growth story,” he said.

The deal is the latest sign that the trend of agribusiness transactions is spreading to second-tier players. Armajaro Trading – the commodities trading group made famous by its co-founder Anthony “Chocfinger” Ward – recently agreed to buy Plexus Cotton, a Liverpool-based trader of the fibre with net assets of just under $17m.

Industry executives believe that medium-sized traders such as Touton and Sucres et Denrées of France, and Ecom Agroindustrial, a family-owned trading group based in Switzerland, could also be involved in future M&A deals in the sector.

The three founders of the Carlyle Group, from left, David M. Rubenstein, William E. Conway Jr. and Daniel A. D’Aniello. Carlyle is part of a small group of investors that will inject $210 million into Export Trading Group, a Tanzania-based agricultural company that controls at least 60,000 hectares of farmland in Africa.

By PETER WONACOTT

JOHANNESBURG—Carlyle Group LP has joined the private-equity crowd in Africa.

The buyout specialist on Wednesday is expected to unveil the first investment of its new Sub-Saharan Africa Fund, one of many looking for capital and deals on the continent. Its foray into Africa represents one of the continent's bigger private-equity investments in recent years. Carlyle is part of a small group of investors that will inject $210 million into Export Trading Group, a Tanzania-based agricultural company that sources commodities from Africa's small farmers and sells those goods to China, India and elsewhere.

[image]

The Pembani Remgro Infrastructure Fund, a South Africa-based private-equity firm, will join Carlyle as well as another partner in the investment, Standard Chartered PLC's Africa Private Equity division. Standard Chartered invested an additional $74 million in Export Trading Group earlier this year. The companies declined to disclose the size of their respective stakes but said the transaction, expected to close this month, would represent a minority investment.

The investments, and Carlyle's nascent Sub-Saharan Africa Fund, targeted at $500 million, show how private-equity firms are trying to position themselves to tap into the continent's new consumers as well companies that are expanding on the back of demand for food and energy from the rest of the world. Competition among global rivals is heating up in Africa, as investment returns diminish in more developed parts of the world.

Blackstone Group LP has invested with other partners in the $900 million Bujagali hydroelectric dam in Uganda, a project that helped alleviate the East African nation's chronic energy shortages. Blackstone's stake is valued at about $120 million, and the U.S. investment firm has agreed to limit its profits on electricity sales to 19%.

Meanwhile, KKR & Co. recently hired Kayode Akinola, a former banker in Europe and deal maker with Africa-focused and London-based private-equity firm Helios Investment Partners LLP, to find investment opportunities in the region.

Africa's prospects appear more appealing than in the past, largely because it is expanding faster than most regions outside Asia and the Middle East. The continent's young people—the average age is 19—are making their way to the cities and stoking consumer demand. More African countries also have become better-governed democracies, providing some political ballast that wasn't present before.

"Political and economic stability are the bedrock of private-equity capital," said Genevieve Sangudi, managing director of the Carlyle Sub-Saharan Africa Fund. "We're here for the long haul."

Carlyle is following others into what remains a tiny market. Only $700 million in private equity was invested in Africa through the third quarter of 2012, according to Emerging Markets Private Equity Association, a Washington-based group that tracks global industry trends. That figure lags behind the $1.1 billion invested in 2011. The vast majority of private-equity deals done in Africa are less than $25 million.

Yet the continent's growth—the International Monetary Fund estimates sub-Saharan Africa's economy will expand 5% this year—is giving rise to African multinationals, such as the Export Trading Group. The company trades 25 different commodities, from cashews to coffee, and is set to double sales. It earned $884 million in revenue in the fiscal year ended March 31 and projects that figure will rise to $1.5 billion in the current fiscal year.

Among other things, Export Trading Group expects to use fresh capital from Carlyle and others to add to warehouses in Asia, where it buys rice and fertilizer. It also wants to expand transport and distribution networks in Africa to get more farm-grown food onto the continental and global markets.

"Agricultural consumption is increasing significantly," said Ketan Patel, managing director of Export Trading Group. "People are eating more as they become more affluent."

—Ryan Dezember in New York contributed to this article.

Write to Peter Wonacott at [email protected]

----

Carlyle finds cashew group to its taste

Financial times | November 13, 2012

By Jack Farchy and Emiko Terazono in London

Carlyle is to lead a $210m private equity investment in an African agricultural commodity merchant that is one of the world’s largest traders of cashew nuts, the latest in a wave of transactions to sweep the agribusiness industry.

The purchase of a minority stake in Export Trading Group will give the Tanzania-based company an enterprise value of more than $1bn, according to people familiar with the deal. It is currently owned by its management.

Alongside Carlyle, the Pembani Remgro Infrastructure Fund, a South African private equity fund, Standard Chartered and ETG’s management will also contribute to the $210m cash injection. Standard Chartered has invested $74m in the company.

The deal comes amid a wave of dealmaking among agricultural traders as they seek to profit from rising trade in food commodities due to strong demand in emerging economies such as China.

This year, several multibillion-dollar deals have been announced, including Glencore’s purchase of Viterra of Canada for more than $6bn, Marubeni’s acquisition of Gavilon for $5.3bn and ADM’s near $2.8bn offer for GrainCorp of Australia.

ETG, which has operations in 30 African countries, specialises in trading niche commodities such as sesame seeds, cashew nuts and pulses. With Singapore-listed Olam, it says it is among the world’s top cashew nut traders.

The capital injection will be used to fund a programme of investment in processing facilities that produce higher-value products such as vegetable oils, flour or ground coffee. The company’s net profits rose 44 per cent to $47.3m in the year to March.

Ketan Patel, managing director of ETG, said the company was well positioned to capitalise on growing strains in global food supplies.

“The last place that has huge tracts of lands that could potentially feed this population of 10bn we are expecting in the next few years is Africa,” he said. “We believe Africa is becoming a more and more important player in the agricultural markets globally.”

Carlyle’s investment is the first by its new sub-Saharan Africa fund, which is expected to raise about $500m. Marlon Chigwendge, managing director of the fund, said that the investment was a bet both on rising demand for food commodities and on African growth.

“The broad story of growth across Africa is there and it is not just a commodities story, it is an internal domestic growth story,” he said.

The deal is the latest sign that the trend of agribusiness transactions is spreading to second-tier players. Armajaro Trading – the commodities trading group made famous by its co-founder Anthony “Chocfinger” Ward – recently agreed to buy Plexus Cotton, a Liverpool-based trader of the fibre with net assets of just under $17m.

Industry executives believe that medium-sized traders such as Touton and Sucres et Denrées of France, and Ecom Agroindustrial, a family-owned trading group based in Switzerland, could also be involved in future M&A deals in the sector.