By Jeff Conrad, Managing Principal and President, AgIS Capital LLC

Institutional investment in farmland grew significantly over the last decade. This growth started in the more developed U.S. market and spread to emerging markets around the world. During this time, the NCREIF Farmland Index, a recognized property index for U.S. farmland, expanded dramatically, increasing from $1.1 billion in 2008 to $8.1 billion in 2017.1 This growth had been fueled by a combination of new properties being added to the index combined with increased asset values. The expansion of the U.S. market was complemented by growth in other key markets around the world, including Brazil, Australia, New Zealand, and Eastern Europe. The trends that drove and shaped the growth of the farmland asset class during this period were multi-faceted, but six, in particular, played significant roles.

The Great Recession of 2008—2009: The global economy took a major downturn in the late 2000s, the period that has been dubbed “The Great Recession”. The downturn was broad and extreme and adversely impacted nearly every asset class in which institutional investors participate. However, farmland was one of the few bright spots during the period. Based on the NCREIF Farmland Index, U.S. farmland delivered a 15.8 percent return in 2008 and followed with a 6.3 percent return in 2009.2 This was extremely attractive investment performance for this difficult and dark period for institutional investors. Based on the NCREIF Farmland Index, the sector followed the downturn with several years of solid, double-digit investment performance. The farmland sector, which historically has performed counter-cyclically to the general economy, performed well during this difficult period. Even during challenging periods, people continue to need food and fiber and this demand provided an underpinning for the farm sector during this era.

For those involved in the farmland asset class during its early days in the 1990s, when its capacity to preserve capital and provide portfolio diversification were the attributes that were most frequently emphasized, the performance of farmland during this period was further proof of the valuable and important role it could play in a broadly diversified institutional portfolio. As major banking institutions collapsed or teetered on the edge during and just after The Great Recession, the Farm Credit system remained active and continued to originate loans. In fact, major farmland portfolios were leveraged during this period at very attractive long-term rates. This strong performance during a difficult investment period helped establish the farmland asset class that we have today.

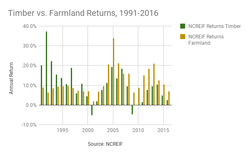

The Faltering Performance of Timberland: For the last 25 years, timberland and farmland, both biologically-based, hard asset investments, have competed for the interest and attention of institutional investors. Both asset classes offer similar attributes in that they have the potential to provide current income as well as portfolio diversification benefits and inflation hedging protection. The timberland asset class became more established in the 1990s based on exceptionally strong investment performance – a result of environmental restrictions being placed on the harvesting of public forests in the Western United States and a massive industry consolidation that led to the liquidation of timberland holdings by the world’s major forest products, paper, and packaging companies. These circumstances provided opportunities for timberland investment management organizations (TIMOS) to become established and to build significant portfolios for institutional clients based in the U.S. and elsewhere. By comparison, the farmland asset class struggled for acceptance because its performance was less compelling when assessed against the temporal case then being made for including timberland in a portfolio. Faced with having to choose between the two asset classes, each offering similar benefits, but timberland offering higher, near-term returns, investors made the easy decision, which led to the more rapid growth of the timberland investment sector.

When The Great Recession hit in 2008, the tables turned for farmland and timberland. Based on data from the NCREIF Timberland Index, after the downturn, the timberland asset class struggled to maintain and regain momentum – generating two consecutive years of negative returns. These, in turn, were followed by several additional years of weak performance relative to the asset class’ most recent trend. This period highlighted the dependence of the timberland asset class on demand for both raw land and building products. Because of weak economic growth, the U.S. housing market floundered for several years after The Great Recession. This led to a decline in land values, especially for timberland assets that were acquired at premium pricing because they were initially assessed as being in the path of residential and commercial development. It also undercut demand for the timberland asset class’ highest value product, sawtimber, which is used to produce dimensional framing lumber. The end result was a prolonged period of weak returns for timberland. TIMOs responded on behalf of their investment clients by allowing their trees to continue growing on the stump – foregoing near-term income in the hope of capturing higher margins from the sale of larger and more valuable sawtimber products in the future. However, this strategy, which was widely adopted because few other options existed for capturing value, only exacerbated the problems TIMOs and their clients faced in the long run because it led to a more sluggish recovery for the timberland asset class. The large supply overhang of sawtimber kept prices suppressed even as the housing market began to show signs of sustained recovery three years ago. Meanwhile, today, the building products sector continues to work through the excess inventory of sawtimber.

As noted, unlike the timberland asset class, farmland came through The Great Recession having generated double-digit returns for investors without a single year in which the sector as a whole produced negative performance. This led to a major shift in how the investment community compared the timberland and farmland asset classes and led to increased allocations by institutional investors to production agriculture.

The Proliferation of Farmland Investment Conferences: In the early-to-mid 1990s, farmland investment conferences did not exist. Farmland investment managers were forced to attend general investment conferences or real estate conferences to educate and pitch investors on the merits of the asset class. During this period, the best one could hope for would be an opportunity to speak or present during a small breakout session at a real estate conference. In other cases, it might be an invitation to be a part of a session on natural resource investing in which the farmland asset class was forced to play “second fiddle” to timberland. For the breakout session speaking opportunities, the sizes of the audiences could vary greatly, with sometimes as few as five people in the audience.

Based on the growing interest in farmland among sophisticated institutional investors and members of the investment consulting community, during the last decade we began to see a voracious appetite for information and perspective about the farmland asset class from investors and their advisors. This led to the development of dedicated farmland and agricultural investment-focused conferences and forums, which has helped enhance the profile and credibility of the sector as a large and attractive destination for institutional capital. The Global AgInvesting Conference, for instance, was launched in 2009 and was followed by other similar conferences where market participants could meet to learn about the asset class and to discuss its ongoing evolution. These farmland-focused conferences and events have provided great opportunities for those who are active in the asset class to meet and conduct business.

Furthermore, the trend is beginning to spread globally, focusing more attention not only on unique geographic opportunities, but also on other opportunities in the agricultural value chain, like processing and ag tech, which can include structured finance and private equity-like dimensions.

The Changing Face of Farmland Investment Structures and Strategies: During the 1990s and 2000s, most farmland investment managers provided separate account investment vehicles for large institutional investors. The managers were generally large insurance companies such as John Hancock and Prudential, which had longstanding histories of agricultural lending. They also included some independent firms founded by former employees of such large insurance companies. Given farmland’s stage of development, and the levels of basic asset class education that were required to establish relationships with investors, the separate account vehicle made sense for the market. Institutional investors would make large allocations to farmland based upon pre-established investment strategies and managers would go about building dedicated separate account portfolios that conformed to their expectations. The separate account had no set life and investment strategies could be adjusted over time based on market circumstances. However, the traditional separate account approach, though still suitable today in many instances, was shown to have limitations that interfered with one’s capacity to generate value and manage risk. During this time period, focus was limited on the U.S. market using traditional geographic and crop-type strategies with many managers employing simple lease-focused strategies. The separate account vehicle’s inherent limitations also curtailed participation in farmland by smaller investors because of the large dollar allocations required to establish dedicated and diversified portfolios.

During the last decade, we have seen significant changes in farmland investment structures and strategies. Many managers have moved well beyond simply buying farmland assets and leasing them to local operators. Farmland investors are now willing to share the upside risk and downside return attributes of the agricultural assets they own with their investment managers and many have shown a capacity to directly operate those assets through their managers, which employ their own property and farm management capabilities. This approach has become especially prevalent in the permanent cropland space (vineyard, orchard, berry, stone fruit, and olive assets, among other commodity types).

We also are seeing an increasingly broad spectrum of investment structures and options – including fund and hybrid strategies – that seek to capitalize on value-chain opportunities through structured finance approaches. Many of these new vehicles and approaches are providing smaller investors with greater access to the farmland sector. We also are seeing investment strategies evolve and become more opportunistic and varied – with some including both real estate and structured finance or private equity orientations. These hybrid investment strategies and vehicles, which also increasingly include “club” deal participation, are at the cutting edge of innovation within the farmland sector.

Finally, as investors become more familiar and comfortable with the asset class, many are showing an increasing willingness to move away from core farmland products, and well-diversified portfolios, to the participating in more focused and opportunistic approaches that emphasize consolidating commodity groups, investing in the organics market, or developing unique value-chain plays. As the farmland market continues to mature, we should expect additional innovations, with new types of investment vehicles being introduced – vehicles that will provide investors with more access and more participation options.

The Expanding Influence of the NCREIF Farmland Index: The establishment of the NCREIF Farmland Index in 1995 was critical to the development of the farmland asset class – and while the index has certain shortcomings, such as its exclusive focus on U.S. assets and its dependency on annual appraisals, it remains the recognized benchmark for the farmland marketplace. Perhaps more importantly, it continues to evolve. The index has grown significantly since being launched and currently tracks 699 properties valued at nearly $8.1 billion.3 During the last decade, as farmland has gained greater prominence, the index has been increasingly recognized and referenced by the academic and investment communities, which now identify it as the bellwether source of metrics for tracking and analyzing the asset class and its performance. It also now includes several sub-indices that provide important performance data on various crop-types (row vs. permanent), commodity groups, and management strategies (leased, variable, and operated). In this way, it has become an increasingly vital tool for those participating in the agricultural investment sector.

Early on, potential investors were clear about the importance of such an index existing for promoting and establishing the credibility of the farmland asset class. Institutional investors expressed a strong need for a robust benchmark that would allow them to track the performance of farmland through time and to compare and measure the relative performance of farmland investment managers. The index provides such a tool, and gives institutional investors a strong framework within which to discuss the merits and tradeoffs of various farmland strategies and investment managers. The development of the NCREIF Farmland Index was critical to the growth of the asset class and and this will continue to be the case as more and more investors participate in the sector in the future. Looking ahead, it is anticipated that other regions will create indices, such as Australia recently did with the assistance of NCEIF in its launch of the Australian Farmland Index.

The Evolution of the Investment Consulting Community: Finally, the investment consulting community serves as a gatekeeper for institutional investor funds. The actual role of the investment consultant can vary greatly depending on the needs and interests of the investor being served. It is not necessary to employ investment consultants, though some investors delegate almost all decision making to a third-party advisor. During the farmland asset class’ infancy, it was difficult to engage the investment consulting community because of a generalized lack of interest in the sector. During the last decade, this dynamic has changed dramatically, with most large investment consulting firms having farmland investment specialists – or specialists in natural resource investing – on staff to advise their clients. This evolution of the consulting business model has been a big plus for farmland investment managers trying to educate the marketplace about the asset class or introduce new and different types of products. Unlike in the past, today there are people on the consulting side of the business who speak and understand the language of farmland and who have the knowledge and context necessary to help their clients make informed and confident decisions about where and how they place capital in the asset class. This has resulted in increased acceptance of farmland and has led to more and larger allocations to farmland managers.

Looking Forward: A continued proliferation of farmland managers and investment strategies is expected in the years ahead. One can draw many parallels to events in the commercial real estate and timberland sectors, which are more established than farmland today after many years of continuous evolution. As farmland continues to gain market acceptance, new managers and investment strategies will emerge and the sector will receive greater attention and achieve increasing levels of growth. This growth will spur innovations, like new holding structures and niche investment strategies, that will open up new geographic regions for investment and result in more varied and creative approaches to agricultural value-chain investing. There are many reasons to be excited and optimistic about the future of the farmland asset class.